WHO WE ARE

ARCHITECTS OF ACTIVE CURRENCY MANAGEMENT FOR INSTITUTIONAL INVESTORS

Adrian Lee & Partners is an independent, employee-owned asset manager that specializes in research-led currency and global asset management.-

- Founding partners pioneered active currency management in 1989 at J. P. Morgan Investment Management

-

- Adrian Lee & Partners was founded in 1999 to focus exclusively on active currency management

-

- Team of 29 with an average of 18 years of experience in currency management

-

- Manage approximately $21 billion at an average 2% active risk, with offices in London and Dublin for clients in the US, Europe and Australia

-

- All currency overlay clients have separate accounts with a range of guidelines and risk management objectives. One process, one team

-

- Over 30 years of positive performance

OUR DEFINING CHARACTERISTICS

Dedicated active currency and global asset management specialist for institutional investors, free from conflict issues

Long-term institutional global client relationships (on average 7 years+)

Quantitative fundamental research with a disciplined methodology

PHILOSOPHY AND APPROACH

OUR INVESTMENT PHILOSOPHY RELIES ON 3 PREMISES

Fundamental economic factors determine currency equilibrium over time

Research-driven valuation analysis identifies departures from this equilibrium

Experienced investment management can exploit these deviations to add return over time

OUR APPROACH

THE OPPORTUNITYCurrency markets are different from asset markets in many important ways.They exist for different reasons, have a heterogeneous set of players with different information sets and objectives.This lack of homogeneity, coupled with a natural tendency towards globalisation, creates an opportunity for active management seen in no other asset class.

Quantitative research with a disciplined methodology is the key to capturing opportunities in the currency market:

-

- Our process uses only proven, repeatable signals

-

- Our investment research has been ongoing and successfully applied in practice since 1989

-

- The research has identified specific fundamental factors that add value in a similar way across the major currencies

-

- Each factor is theoretically logical and separate and when applied in a linear framework generates a high and stable information ratio

-

- Significantly, each factor works in a similar way across developed and emerging market currencies

While a quantitative research driven model defines our approach and captures alpha in a disciplined and unemotional way, what differentiates us from other approaches is our 3rd Alpha Centre. We look forward into the future by actively forecasting fundamentals daily. This forecasting activity is NOT an override of the model or a supervisor of the model; it is a truly separate and independent source of return.

OUR PROCESS

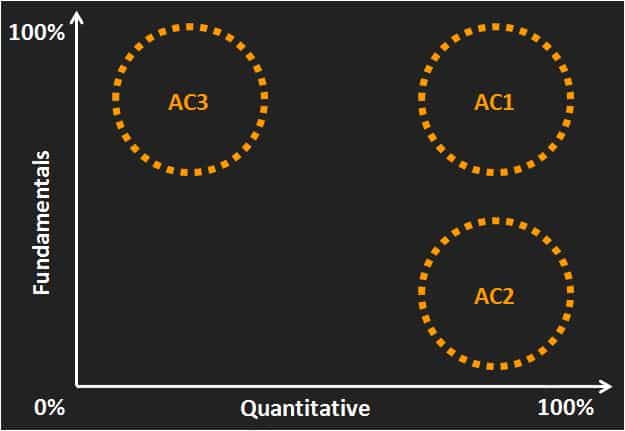

Our active investment process is implemented through the three separate and diversified “Alpha Centres”.

ALPHA CENTRE 1

Observed differences in today’s fundamentals (e.g. favour higher yielding currencies)

ALPHA CENTRE 2

Observed recent trends in currency (e.g. favour a currency that has appreciated)

ALPHA CENTRE 3

Active forecasting of future fundamentals

WHAT WE DO

CURRENCY PRODUCTS

We offer a range of currency management solutions that reduce currency risk and enhance portfolio returns.

GLOBAL MACRO ALPHA STRATEGY

Maximize hedged return Maximize hedged return Maximize currency surprise

Global Equity

Global Fixed Income

Currencies

CAREERS

Join our team

– Quantitative Research

– Portfolio Management

– Economics

– Trading

– Software Development

– Compliance and Risk

– Corporate

Email your CV to [email protected]

WHY ADRIAN LEE & PARTNERS?

As a leading active currency management firm with a growing institutional client base, Adrian Lee & Partners is always seeking remarkable people to join our team.

We attract the best talent in the investment management industry by offering an opportunity to join a:

– 100% employee-owned specialized active currency management firm

– Investment specialist culture

– Career growth opportunity

– Collegial environment

CONTACT

LONDON, UK

Smithson Plaza

25 St James’s Street

London SW1A 1HA

UK

+44 207 427 6960

[email protected]

DUBLIN, IRELAND

West Pier Business Campus

Dun Laoghaire

Co. Dublin

Ireland

+353 1 6318 500

[email protected]