Currency primers and published articles

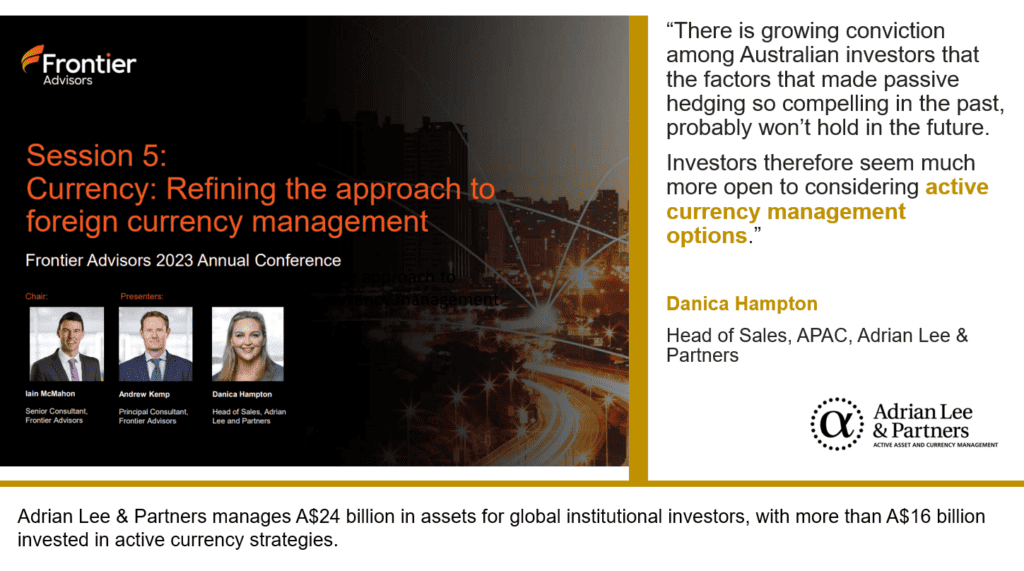

Adrian Lee & Partners shared insights on currency solutions for Australian investors at the Frontier Advisors 2023 Annual Conference

Adrian Lee and Partners took part in the Frontier Advisors 2023 Annual Conference on 15th June 2023 in Melbourne, Australia. Our Head of Sales – APAC Danica Hampton joined other experts in a Currency panel discussion and shared her views on how Australian investors can extract more value from foreign currency management.

Key takeaways from the session are:

• The foreign currency market environment has changed;

• Passive currency hedging has served us well, but has its limitations to deal with the current market backdrop;

• It is worthwhile for investors to consider flexible customised foreign currency hedging solutions to help align outcomes with objectives and improve portfolio flexibility;

• Active management in foreign currency has yielded positive return outcomes in recent years which have been uncorrelated to risky assets.

By Adrian Lee & Partners’ research team

Podcast

“We talk about currency volatility, but currency loss is the issue” quips Adrian Lee, the President and CIO of the currency management firm Adrian Lee & Partners, in our latest podcast episode when discussing how investor attitudes have changed recently as a result of increased FX volatility.

Lee also discusses the key geopolitical and fundamental factors likely to impact the currency markets this year, explains why FX can often become a “hidden” investment within portfolios, breaks down a number of different approaches towards currency management and speculates on what a Martian seeing this asset class for the first time might make of it.

Cryptocurrency Overview

In this paper we ask, what is a cryptocurrency? and what place (if any) does cryptocurrency have in a diversified portfolio alongside traditional asset classes? We conclude that cryptocurrency is neither a currency, nor a commodity, and that it does not make a good inflation hedge. Some cryptocurrencies have properties that make them more like art or other collectables than any traditional asset class or good.

By Adrian Lee & Partners’ research team

Currency for Institutional Investors

Discussion of approaches to currency management from an institutional investors’ perspective.

By Adrian Lee & Partners’ research team

| Currency in International Investing – A Framework for Addressing Currency Research outlining a framework for managing currency exposure inherent in international investment, focusing on addressing three main policy issues, namely: (1) What is the appropriate strategic or long-run exposure to currency?; (2) Should currency be managed actively around this strategic position?; and (3) Who should manage currency exposure and how? By Adrian F Lee, inStrategic Currency Investing, Probus Publishing Read more |

International Asset and Currency Allocation

Article demonstrating that separate decisions for asset and currency allocations can significantly improve the performance of international fixed income portfolios.

By Adrian F Lee, in Journal of Portfolio Management, Institutional Investor

Strategic Currency Hedging in Emerging Markets

Article showing that a diversified basket of emerging market currencies has a significant correlation to global equity markets, while a similar basket of developed market currencies does not. It then considers exposure to developed and emerging market currencies separately, and derives the optimal hedge ratio for each within the classical mean-variance framework of asset allocation for a diversified portfolio of global equities and bonds.

By Daire Mc Nally and Edward Murray, in, Financial Standard

| International Risk Premium Is an Attractive Separate Asset Class Evidence that International Risk Premia are a logical and attractive source of long term expected returns, and that these premia are highly diversified by asset class, country, and region. By Adrian Lee & Partners’ research team Read more |

| Emerging Market Currency An analysis of the characteristics of emerging currencies which shows that there is a weak yield advantage to holding emerging currency or using an unhedged benchmark, and that tactical active management significantly enhances return to emerging markets currency exposure and can protect against sharp devaluations. By Adrian Lee & Partners’ research team Read more |

| Illustrative Currency Risk Report – US Perspective Research into appropriate hedge ratio for developed and emerging market currency based on different scenarios. By Adrian Lee & Partners’ research team Read more |

A Practitioner’s View: The Importance of Separating Bonds and Currencies

Analysis highlighting the importance of separating the investment process into two components – bond market selection and currency decisions, and the optimal portfolio construction process that consists of four parts: separating investment process into bond market selection and currency decisions; constructing portfolios that combine the most attractive bond markets with the most attractive currencies; protecting against unattractive currency movements through currency hedging; and exploiting inefficiencies in specific markets through issue selection and yield curve management.

By Adrian F Lee, in International Bonds and Currencies, Dow Jones-Irwin

The Case for Active Currency Management

Research into whether the currency market displays the conditions of an efficient market from a theoretical standpoint, together with an examination of the investment management industry evidence on the return to active currency management.

By Adrian Lee & Partners’ research team

International Asset and Currency Allocation – the long run international asset allocation issues that confront US investors

Discussion of the international asset allocation issues that confront U.S. investors, which are: international vs. domestic assets; international equities vs. international fixed income; foreign currency exposure vs. foreign asset exposure, and how these issues can be addressed optimally.

By Adrian F Lee, in Active Asset Allocation, Probus Publishing

| International Asset and Currency Allocation Research using data from the previous 13 years to illustrate the effects of a full hedge and a partial hedge on a U.S. investor’s normal international equity and fixed-income portfolios. By Adrian F Lee, in Handbook of International Investing, Probus Publishing Read more |

Optimal Currency Hedging Strategies

Discussion of the strategies available to investors in the international fixed income markets, including the optimal construction of an asset portfolio and a separate optimal currency portfolio.

By Adrian F Lee, in Handbook of International Investing, Probus Publishing

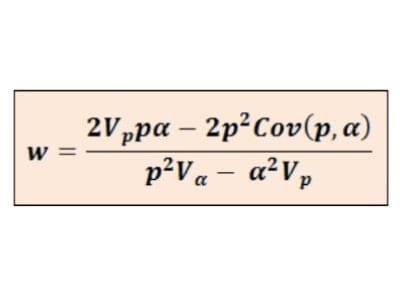

Mathematics of Optimal Currency Alpha Allocation

An analysis of the portfolio optimisation mathematics for currency alpha and how it differs from that of other asset classes.

By Adrian Lee & Partners’ research team

Active Management in More Than One Asset and The Role of Correlations

Analysis showing that correlations are a far less important contributor to overall performances of the individual investment processes, and that allocating a portfolio to a suite of specialists rather than one generalist is optimal, largely irrespective of corelations.

By Adrian Lee & Partners’ research team

Balassa-Samuelson and The International Risk Premium

Research into the appropriate process to capture interest rate factors (buying high interest rate currencies and selling lower interest rate currencies), and trade-based factors (investing in countries with high export-led growth, funding those with lower growth).

By Adrian Lee & Partners’ research team

Options or Forwards? It’s All the Same in The Long Run

Analysis showing a sequence of option payoffs converge in time to a payoff that can be realised using forwards.

By Adrian Lee & Partners’ research team

Currency-Hedging Implementation Issues

Research into the appropriate strategy adjustment for international investment managers whose normal currency exposure is hedged; the relative benefits of adding currency overlay; and the transaction costs and cash flows associated with currency hedging.

By Adrian F Lee, in The Currency Hedging Debate, IFR Publishing

Currency Management for Life-cycle Funds

Research into optimal currency management or life-cycle funds, suggesting that risk due to unintentional currency exposure through foreign asset allocation is bigger in a young person’s portfolio than that of an older person’s portfolio, but can be tolerated because there is more time to weather the fluctuations. However, this risk should be reduced in an older person’s portfolio in order to benefit from the attractive returns available through active currency management, but should be scaled back as the investor gets closer to retirement.

By Adrian Lee & Partners’ research team