What is currency overlay?

Currency overlay refers to the specialised management of currency exposures inherent in an international asset portfolio, by a separate firm or entity from the asset manager.

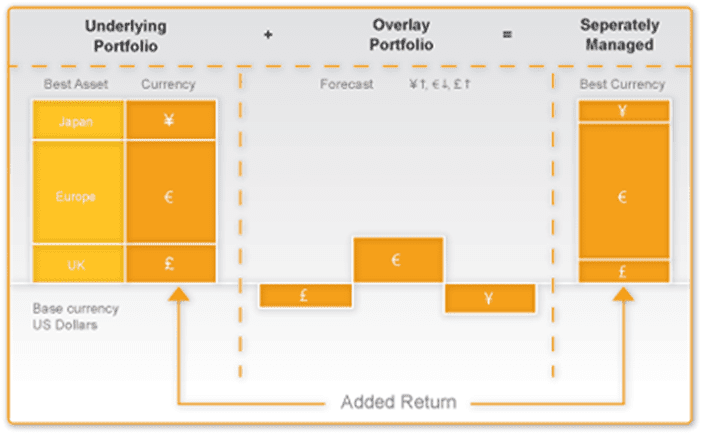

Every investment in an international asset requires an equal investment in foreign currency. A currency overlay manager is dedicated exclusively to managing these ‘accidental’ currency exposures generated by the asset manager, separately from, but in parallel with, the underlying asset manager.

The underlying asset manager is not disturbed by the use of an overlay manager, and still manages currencies in the same manner as before. However, the overlay manager replaces the currency bets of the underlying manager with the deliberate investment position of the specialist overlay manager.

The resulting combination of managers facilitates the optimal combination – best currency decisions from the currency specialist, and best asset decisions from the asset manager.

A currency overlay programme usually reduces pre-existing unmanaged currency risk, as it hedges pre-existing exposures.

How it works

Through the application of a portfolio of forward contracts, known as the overlay portfolio, the underlying currency exposure of the assets is altered to a deliberately intended portfolio of currency exposures. This separately managed currency exposure can be expected to have a higher return than the original set of exposures, generated accidentally by the asset manager.

In Practice

- Custodian sends currency exposure to overlay manager regularly.

- Overlay manager enters forward currency contracts in client’s name.

- Custodian settles contracts upon instruction of overlay manager.

- Client provides any cash needed at settlement.

I consider investing in currencies as speculation. We are long-term investors and this is not our policy.

Currency exposure from an unleveraged overlay program never exceeds the unmanaged exposures, and never goes below zero. It cannot be speculation if it is reducing an existing portfolio risk.

My underlying manager favours ‘naturally hedged’ assets, so the currency exposure is already hedged.

Individual assets may be naturally hedged, but the portfolio of assets denominated in each currency is not. A natural hedge means that there is a big negative correlation between the asset and the currency, this has rarely been observed. Also, correlations are volatile and natural hedges often fail. It is a risk to consider the portfolio hedged.

My equity manager includes currency in his investment process, so why do I need overlay?

The answer here is one of who is the most appropriate. Ask the equity manager the following three questions:

- What is your currency benchmark?

- What is the currency investment process?

- What has been the currency performance?

Also, ask an equity manager the following two questions:

- How much can currency impact on the portfolio?

- Who is responsible for these impacts?

An overlay program adds too much complication from an administrative side.

Contrary to popular opinion, overlay programs are relatively simple to establish and maintain.

The majority of funds choose to have their master custodian collate the data from each of their individual asset managers, and then forward the cumulative data to the overlay manager. These data can be forwarded as frequently as the custodian is confident that the data are correct, but it is recommended that the reporting frequency be no less than monthly.

Any strategy positions are implemented through the use of currency forward contracts. At the inception of the account a ‘rollover date’ is chosen for the account, which is typically 3 months in the future. All currency trades on the account will settle on that date, which means that only one cash flow takes place on the account.

What are the most common ways of dealing with cash flows that arise when forwards settle?

While not absolutely necessary, many clients set aside a cash pool of typically 5% of the value of the net value of the outstanding forward contracts to deal with any cash flows that may arise.

Until the cash flow is realised, the cash pool is equitised with futures, ensuring that the funds earn an appropriate return. The level of cash within the account fluctuates with the cash flow of the overlay account. If the level of cash within the corridor account falls below 3% of the portfolio, it must be replenished to the 5% level.

Conversely, if the cash level rises above 8%, the client can withdraw funds down to the 5% level. Alternatively, clients can also leave standing instructions for the custodian to sweep cash in and out of a STIF account (a cash-type account used to settle transactions) to fund currency gains and losses. Instructions are confirmed 3 days in advance between manager and custodian.

Why don’t all funds run overlay programs?

Eventually they will!

The advisability of running an overlay program depends to a large extent on the size of the international portion of the fund. As a rule of thumb, we would advocate that funds consider an overlay program if the size of their international exposure is over US$100 million or equivalent, or accounts for over 10% of their total portfolio. Smaller funds tend to find that the required investment of time and expertise in running an overlay program does not reap sufficient rewards to justify the investment, however each fund should evaluate this from their own perspective.

What is the size of the overlay industry?

Although there are no official figures available, it is estimated that there is currently US$100 billion overlaid in the United States alone.